PDF editing your way

Complete or edit your 1040ez anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 2011 federal tax form 1040ez directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 1040 ez form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 2016 1040ez form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 1040-EZ

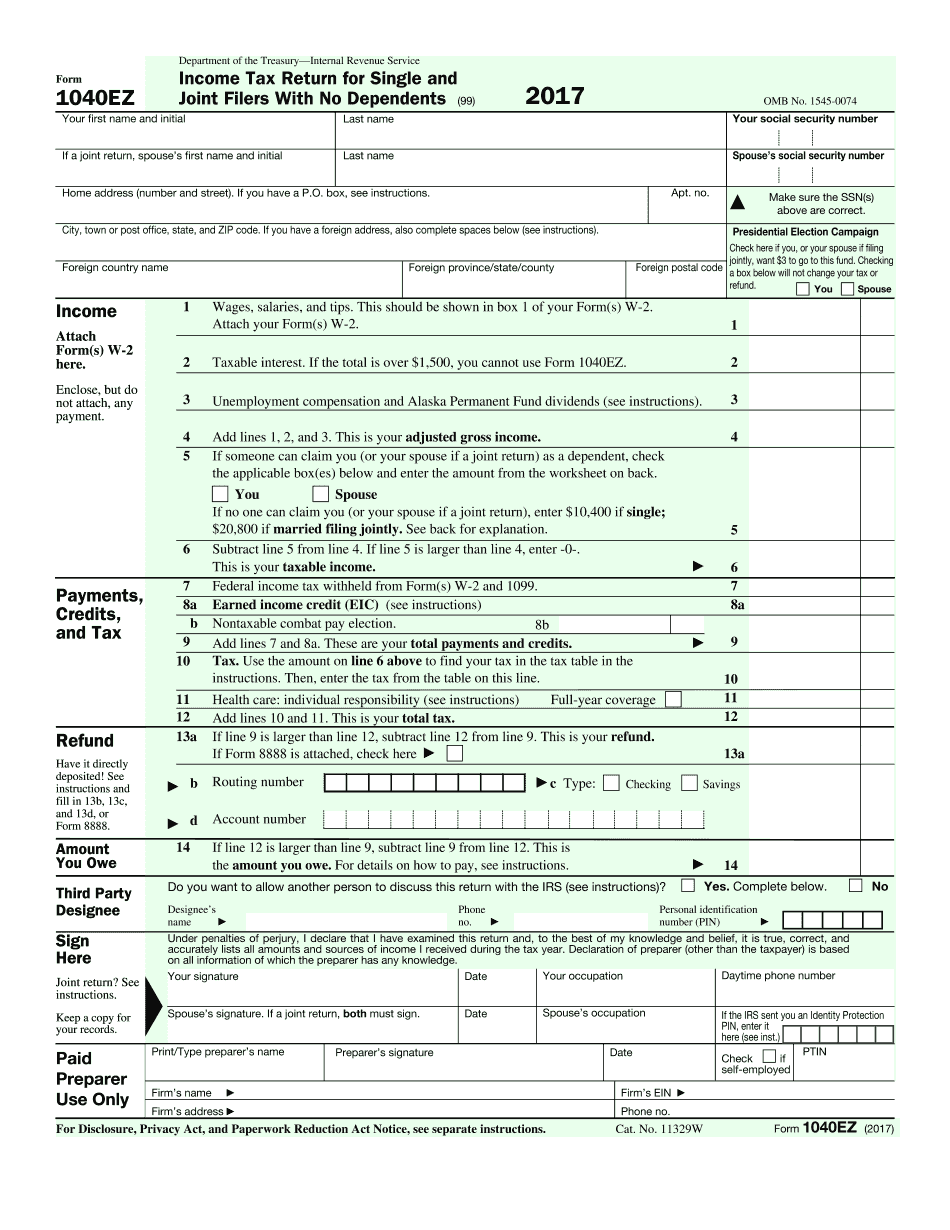

What Is 1040ez?

1040-EZ Form is a short version of the 1040 and it is the simplest variant to fill out. The sample works for the taxpayers with basic tax situation and for those who meet specific conditions. Fill out 1040ez if you have taxable income of less than $100,000, interest income of $1,500 or less.

Tax filest must have no dependents and be under the age of 65. No matter whether you are single or married, you may file this document jointly with your spouse. Don’t use this template in case you are currently in Chapter 11 bankruptcy.

The taxpayer also must not have any taxes on the employment of a household employee, such as maid. Consider, that filing this form you can not claim any revenue adjustments, including student loan interest deductions for retirement contributions or any credit other than the earned income credit.

The following information should be necessarily included:

- Common data identification information.

- The revenue section, including wages, taxable interest, unemployment compensation, etc.

- All your payments, credits and tax that consists of federal income tax, earned revenue credit.

- Your refund.

- The amount owed.

- Your signature.

It is very important to not forget to sign the template after completing. You are provided with ability to add your signature electronically by typing, drawing or uploading and to send the ready 1040-EZ via email or fax.

Online remedies help you to prepare your doc administration and raise the productiveness of one's workflow. Abide by the short guideline to entire Form 1040-EZ, refrain from errors and furnish it inside of a timely fashion:

How to complete a 1040ez Form?

- On the website aided by the type, click on Start off Now and go with the editor.

- Use the clues to fill out the applicable fields.

- Include your individual facts and speak to information.

- Make convinced that you enter appropriate knowledge and numbers in ideal fields.

- Carefully check out the content material with the kind too as grammar and spelling.

- Refer to help section should you have any concerns or tackle our Support crew.

- Put an digital signature on your Form 1040-EZ aided by the assist of Indication Resource.

- Once the form is accomplished, press Completed.

- Distribute the prepared sort by means of electronic mail or fax, print it out or conserve in your unit.

PDF editor helps you to make modifications to your Form 1040-EZ from any web linked unit, personalize it in keeping with your preferences, signal it electronically and distribute in several means.