Award-winning PDF software

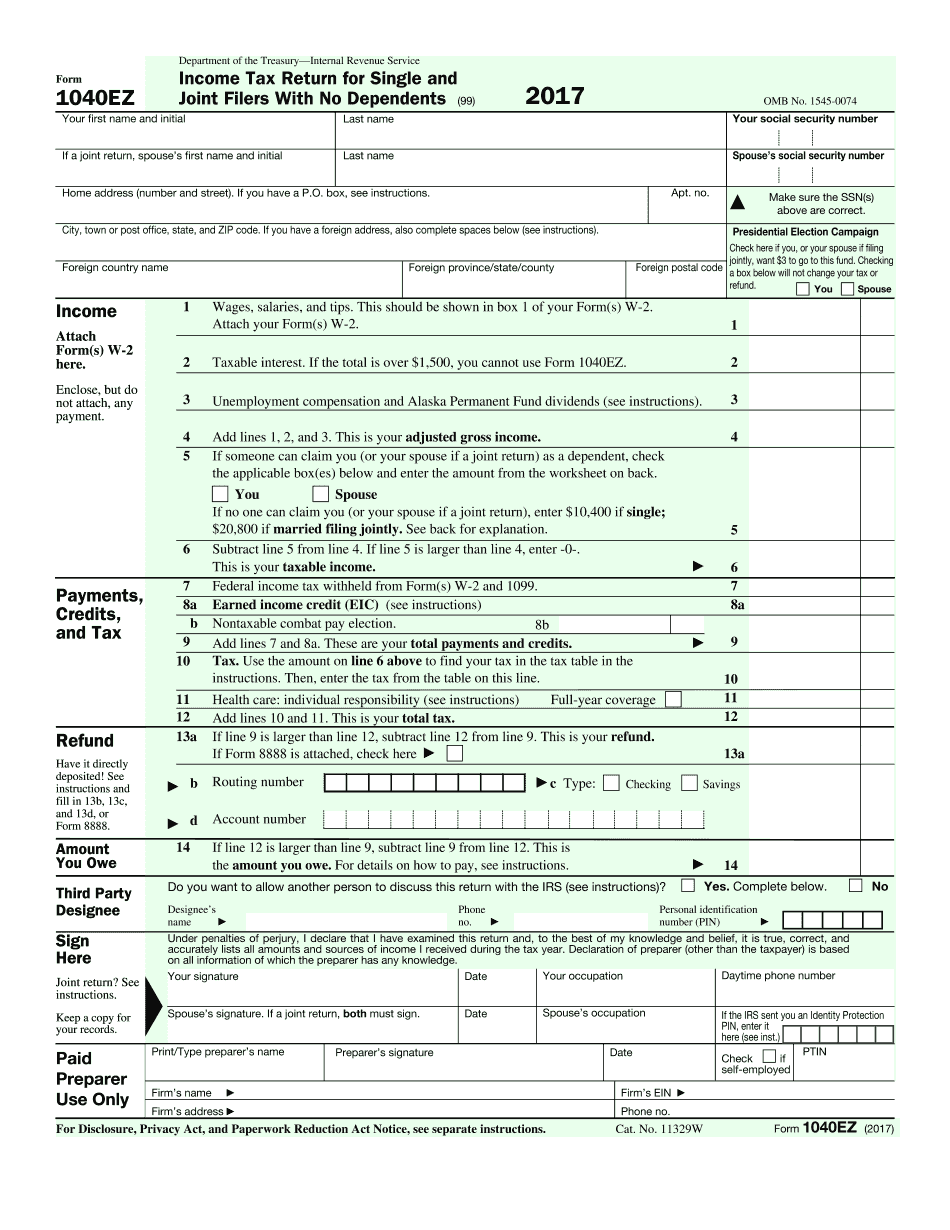

1040ez instructions 2025 Form: What You Should Know

Form W-2, U.S. Tax Form, is available for individuals and for employers and self-employed persons. It is used to report wages and other income earned by employees. This information is used to calculate your net wages for unemployment, unemployment compensation, and other programs based on wages reported on Form W-2. The self-employment tax law applies when a firm or business does not have a Maryland establishment. Tax on the dividends you receive. The dividends you receive are reported on Schedule V of the tax return, which will be due on Form 4797. Tax on the interest on the money you pay to a bank. Interest paid on money borrowed and on deposits of money held by a bank or a savings and loan association. You may be able to deduct or not deduct the interest due on a federal tax return, depending on whether the interest is earned from money outside of Maryland, and if the interest is not in addition to your state's tax. Deductions. Many deductions can be claimed. These include income, loss, deductions, employee and employer itemized deductions, and mortgage interest deduction. Tax code change December 31, 2025 — Tax Code Change. The federal tax rate is reduced to 0.5 percent on all federal income tax returns from 5.0 percent. The rate is lowered to 0.25 percent on all federal income tax returns from 5.0 percent. The rate reduction applies to both tax filers with zero liability and those with one or more years of liability. The state tax rate will remain at 5.0 percent on state income tax returns. Additional tax relief. The changes to the federal tax law will provide special tax relief to low income individuals on tax year 2025 income tax returns starting in 2018. The tax law provides a reduction of 10 percent on the federal income tax rate and 7.5 percent on the local income tax rate for federal returns filed on or after December 31, 2022, and for federal returns filed on or after January 1, 2023. The law provides an additional relief for individuals who filed a complete personal federal tax return on or before January 1, 2019, and who are married filing jointly, or filing a joint return, and who have zero or limited liability for tax. This relief provided in the federal tax law is not applicable to tax returns filed on or after the effective date of the legislation (December 31, 2018).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.