TUTORIAL: Get Turbo Tax: Learn How to Buy, Install, and Save Tax Software. For

Updated: 02/09/2018). TUTORIAL: Get Turbo Tax: Learn How to Buy, Install, and Save Tax Software. For more information about Tax Form 1040 – 1041 clicks here. For more information about Tax Form 1040EZ or TurboT ax: Tax Tips & Videos click here. If you are filing under a standard tax year, the standard tax year begins on January 1st of the year you file your return. A separate tax season starts on January 31st of the year after you file your return. Please download your complete tax return now. More about standard and special returns here. Specialized returns: Specialized tax returns for those with medical expenses. More about special returns here. More TurboT ax Online resources: Learn more about TurboT ax: TurboT ax Business, TurboT ax Individual, TurboT ax Exemptions, TurboT ax Credits, and TurboT ax Paying & Withholding. Learn how taxes work, what your taxes look like, and how to use the software for your business. More about TurboT ax Business here. Learn more about TurboT ax Individual here. Learn more about TurboT ax Exemptions here. Learn more about TurboT ax Credits.

For any changes to your order, please feel free to call me) or email me at

For any changes to your order, please feel free to call me) or email me at bamchubz.com 5 Donation for your Charity of Choice. 15 Charity of Choice Click here for Event Information 65 Donation (includes ALL food/drink) All participants must be 21+. Must wear shirt/hoodie & bring picture ID. Registration is now.

To help you figure out how to file the appropriate forms for you, go to

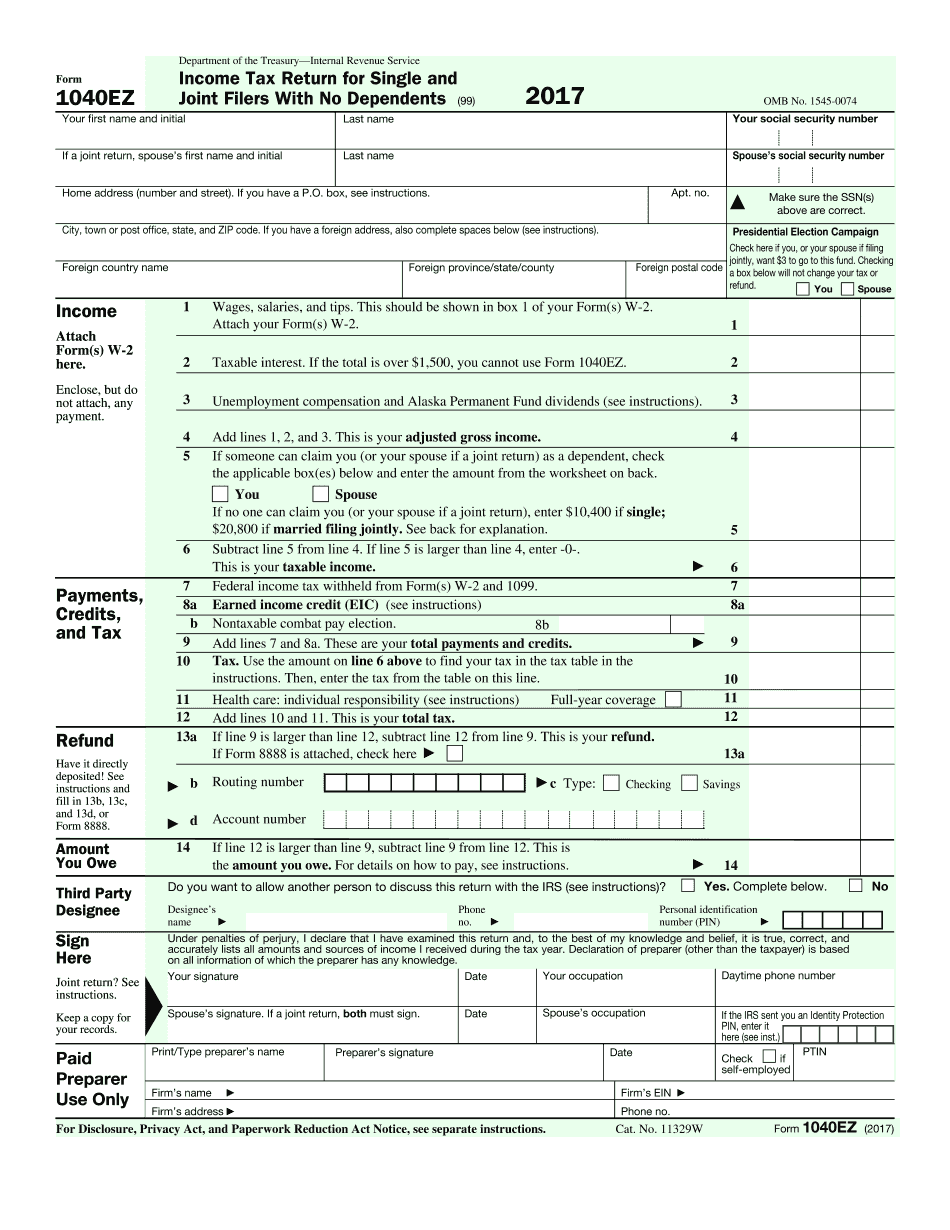

If the only tax you owe is a relatively small amount, you generally won't need to be worried about using a specific form or filing your return at this time. In this circumstance, you will most likely simply need to file either a Form 1040 or a Form 1040EZ. This allows you to claim credits against your return when you meet certain criteria and your return is approved. To help you figure out how to file the appropriate forms for you, go to IRS.gov/Forms for information on the most popular IRS forms, from 1040 to 1040EZ. For additional information, visit IRS.gov/filingTips. What IRS Form To Use — 1040A and 1040EZ Both of these Forms are tax forms made applicable to individuals and businesses. You need to file these forms if you are a dependent taxpayer. If you're not a dependent taxpayer, you can use a Form 1040A or Form 1040EZ to figure the amount you have to pay each year. If you are required to use a 1040A or 1040EZ, you'll need to complete and attach a joint Federal Income Tax Return (Form 1040), line 10. For more information on which IRS form to use, go to IRS.gov/Forms. Additional resources on the U.S. tax system are available at.

File online or download the free IRS Free File or IRS e-file software and send

FOR Tax Return Forms | WV Division Of Revenue. Return To Top How do I file a tax return? File online or download the free IRS Free File or IRS e-file software and send a completed and signed return by mail; File a paper return by mail or in person at one of over 1,250 government offices; File paper returns when you file your federal income tax return; Download a paper form (available at IRS.gov); File electronically when you file your state and local income tax return; Complete and mail your tax return; or, Attest on the back of your tax return that you have received a government issued, signed tax return form. Download a Free IRS e-File Application Return To Top What are some things that I must include on the return? The original return or a copy of the return with the information missing, deleted, revised or replaced must be sent to the same address we received the original Form 1040. If you send your return by mail, we strongly recommend that you enclose a copy of your state-issued driver's license or other form of identification with the return. The address we provide on the return is the mailing address where you can be contacted for further information during the filing period. All returns must be mailed or hand-delivered to: Internal Revenue Service, COUNTY OF: STATE: CITY: ADDRESS: We need the following information for each taxpayer. The filer's Social Security Number or tax ID Number. Income information for the current year, as shown on the.

Internal Revenue Service. Available Online. Internal Revenue Service.

Internal Revenue Service. Available Online. 1040EZ: Income Tax Return for Single and Joint Filers With Single Dependents Definition. Internal Revenue Service. Available Online. 1040EZ: Income Tax Return for Single and Joint Filers With Multiple Dependents Definition. Internal Revenue Service. Available Online. 1040EZ: Income Tax Return for Single and Joint Filers With Qualifying Spouses (TSP) Definition. Internal Revenue Service. Available Online. Form 1040-INT: Income Tax Return Without Certain Specified Information Definition. Internal Revenue Service. Available Online. Form 1040-SA: With Certain Designations and Other Special Tax Forms, Tax Return Without Certain Specified Information Definition. Internal Revenue Service. Available Online. Form 4789: State Unemployment Incentive Filing Status — Social Security — Form SSA-1094A-PRL Definition. Social Security Administration. Available Online. Form 4884: State Unemployment Incentive Filing Status — Social Security — Form SSA-1094B-PRL Definition. Social Security Administration. Available Online. 1040-AIM: Income Tax Return With Specified Information Definition. Internal Revenue Service. Available Online. Form 4567-TR: Information Return for Persons Serving Temporary Hospitalization in a Qualified Care Facility Definition. Internal Revenue Service. Available Online. Form W-2G: Form W-2G for Employees Making Under Minimum Wage Qualifications and Adjustments. Internal Revenue Service. Available.

Award-winning PDF software