Award-winning PDF software

About form 1040-ez, income tax return for single and joint filers

EI employees who work in a government organization. Form 1040-K is a joint return file of taxpayers who have filed a joint return for the purpose of reporting a joint income. Form 1040-Q is a non-Joint Return Tax information for employees of corporations who file on behalf of shareholders. Tax information for employees of corporations who file on behalf of shareholders. Filing an income tax return is the same regardless of how or whether you have a dependent. Forms that are filed for tax purposes and that are subject to audit. Filing Forms that are filed for tax purposes and that are subject to audit. The purpose of Form T2081 is to keep the names and addresses of corporations and to disclose the income, deductions, credits, and losses which a corporation may recognize. Forms which indicate the filing status of the taxpayer. Form T3012 is for persons reporting capital gains, such as dividends. Forms.

Forms, instructions & publications - internal revenue service

About Form 942, Nonprofit Corporation Election Notice. About Schedule P, Qualified Dividend. About Form 2106 with Attachment. About Form 2106 with Attachment. About Schedule D. Forms for Individuals for Tax Planning and Tax Relief About Form 1040EZ and Form 1040, Election for Single Filers. About Form 1040NR. About Form 4868. Forms for Entitlement to Certain Tax Breaks About Form 1040, Election for Dependent (Student) Tax Credit. About W-2G Forms About Schedules H & I. Forms for Exemptions for Individuals and Other Entities Form 1040EZ. About Schedule H and Form 1040. Tax Tips for Small Businesses. About Form 8582. Tax Tips for Individual Investors. About The 401(k) Plan. About Form W-2. For information on how to file a Form 1040-ES: About Forms 1040-ES. Tax Tips for Individuals. About the Qualified Dividend. About The 1040-SEP Election. Tax Notes (PDF) About the S Corporation Election Form 1040.

What is form 1040ez?

However, many tax planning experts advised you should use Form 1040, which will allow you to claim most of the same credit but allows you to only receive a maximum of 10,000 in deduction deductions from your tax bill, as opposed to 19,000 as per Form 1040A. Tax filing date: May 1, 2016 June 30, 2018, Form 1040EZ vs. Form 1040 Form 1040EZ vs. Form 1040 Before it was discontinued, Form 1040EZ allowed you to claim a handful of credits and deductions on your tax return. However, many tax planning experts advised you should use Form 1040, which will allow you to claim most of the same credit but allows you to only receive a maximum of 10,000 in deduction from your tax bill, as opposed to 19,000 as per Form 1040A.

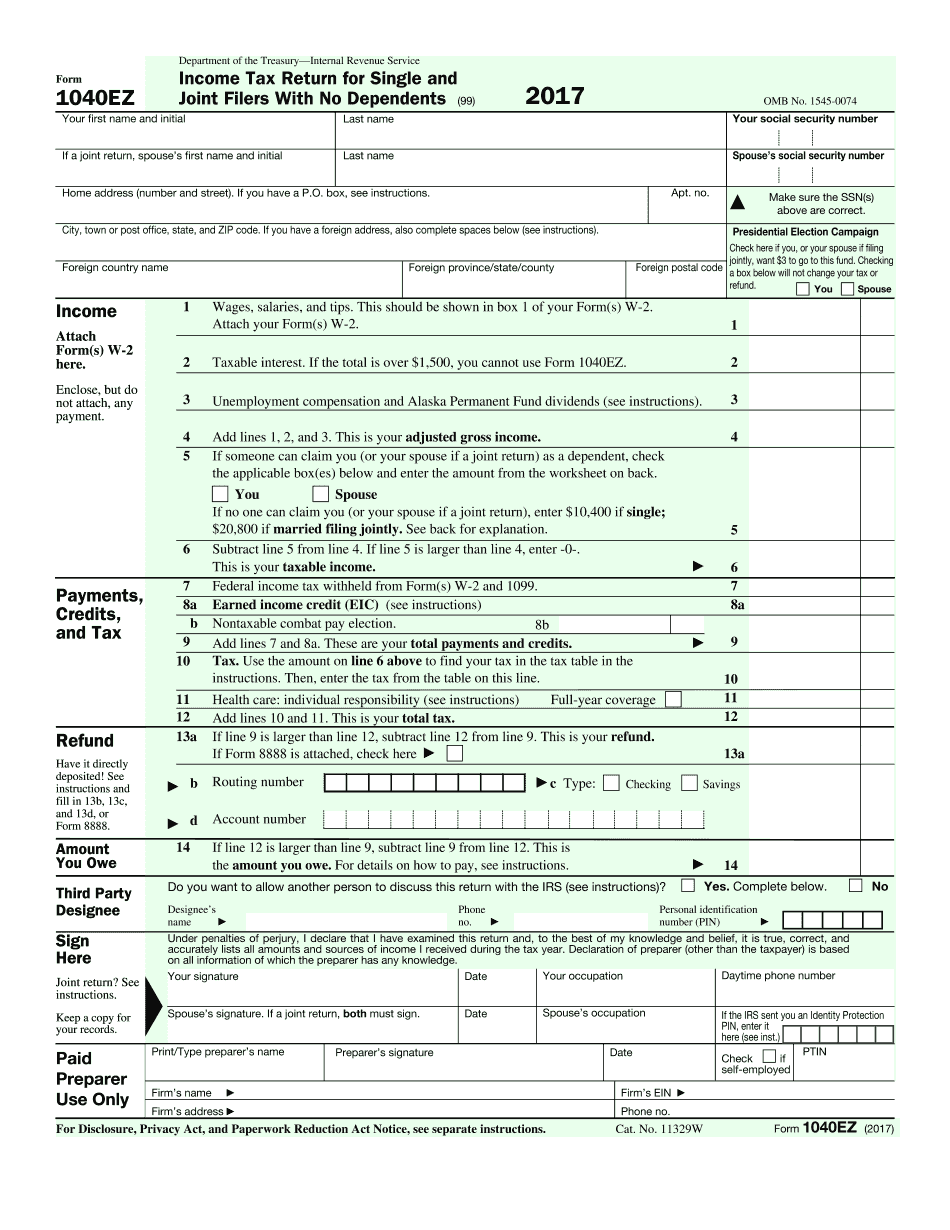

Form 1040ez: income tax return for single and joint filers with no

The 1040EZ is a simplified form that is intended to facilitate the filing of returns on a timely basis. This form will help you prepare your 1040A tax return, estimate your taxes, and check tax credits against your taxes. You don't necessarily have to file the 1040EZ. However, if you choose to file this version of the Form 1040 for your 2013 tax cycle, then you will need to use the electronic version of Form 1040EZ because the traditional forms don't transmit electronic data to the IRS or to financial institutions for filing purposes. If you don't use e-filing (that is, you file your Form 1040EZ using the paper version), you will need to submit your 1040EZ in a paper envelope. This form contains data that is updated on the day after the return is filed. The IRS can identify potential mistakes with the information from this form. For example, there.

U.s. 1040ez tax form calculator

PDF file, sign in to your Account account with your My Account details and then click on Tax Information page, and you are ready to go — in under 10 minutes you will have all your tax information on your My Account. Our Tax Forms are now listed on the following IRS website: We also recommend you read our 1040EZ for Citizens.” 1040EZ for Citizens - for information about how to fill out the 1040EZ and other tax forms for citizens, and nationals. Click here for complete instructions to fill out a 1040EZ and the 1040A and 1040EZ for Nationals If you are the , Territory etc. resident (domiciled) in Canada, you will need to obtain your own 1040EZ and the Non-Residents 1040A and 1040EZ. Expat Tax Tip : The 1033 expat tax is not based on residency or physical presence. The 1033 is only applicable if the tax was received after.