Award-winning PDF software

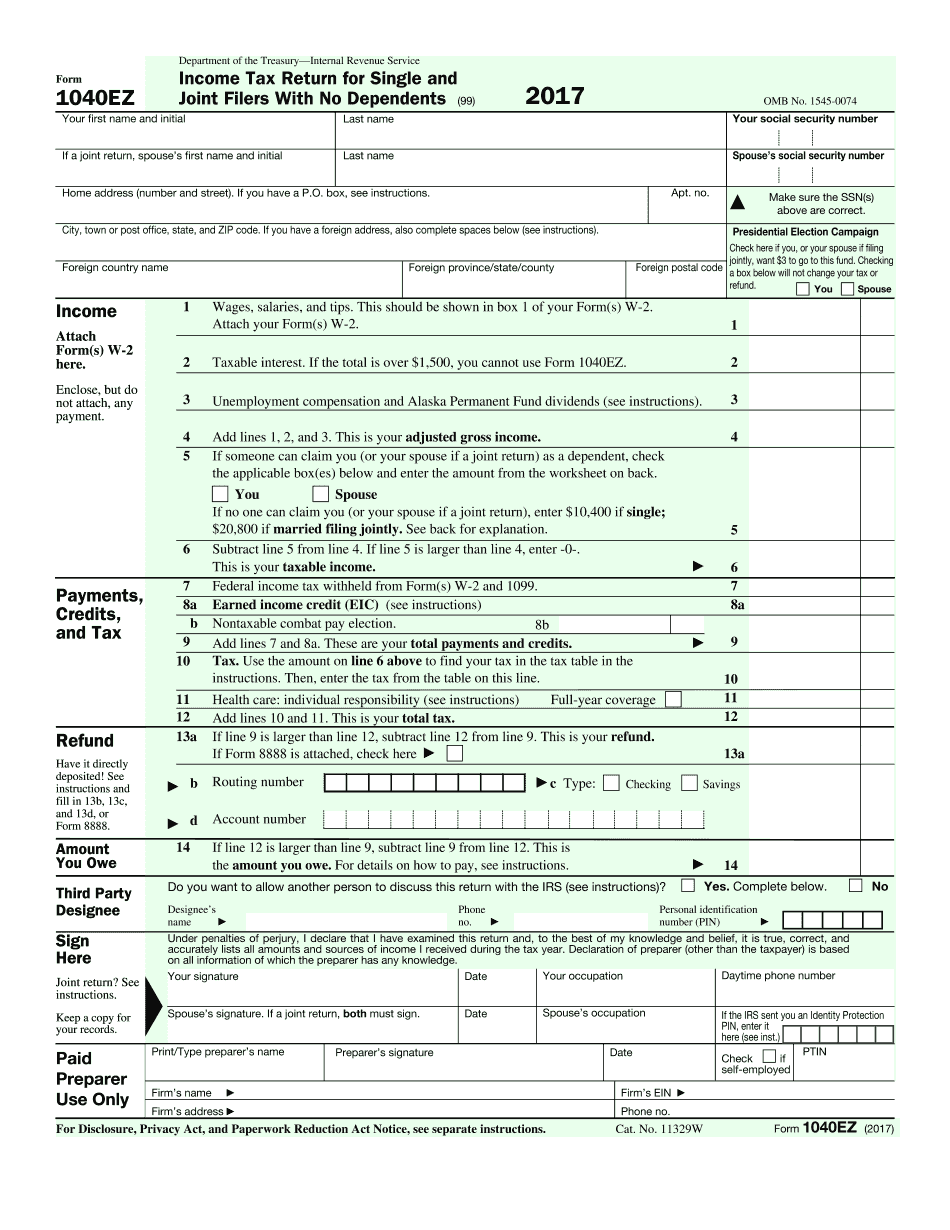

Santa Ana California Form 1040-EZ: What You Should Know

G., interest and rental income) are exempt from California Corporate Income Tax for tax year 2032 onward If more than one taxable year is being used, the taxpayer filing the return needs to use the form for the taxable year that begins on the date in which the first tax year begins. Tax Returns — The New U.S. Tax Code, 2011: April 14, 2025 — Taxpayers will now be able to file electronically, a service first made available in 2005. April 7, 2025 — Form 1040, Individual Income Tax Return for Tax Years 2025 to 2025 (for filing in person) April 7, 2025 — Form 1040, Individual Income Tax Return for Tax Years 2025 through 2025 (for filing by mail) April 7, 2025 — Form 1040A, Individual Income Tax Return for Tax Years 2025 to 2025 (for filing electronically) Apr 17, 2025 — Form 1040, 1040A Tax Return, includes instructions, schedules and supporting documents. Form 1040, 1040A Tax Return (with Form 1040, 1040A), includes instructions, schedules and supporting documents. The last version of the tax calculator is available HERE. Note you will need to create an account and enter in your income. Apr 23, 2025 — IRS will soon begin accepting Form 1099-MISC from taxpayers. Form 1099-MISC will include an estimate of the amount of U.S. income tax a person would have owed had the person paid the income tax due each and every year, without taking any deductions or credits for the year. Please have all available documentation, including all pay stubs, pay stubs for the last three years when filing Form 1099-MISC. Form 1099-MISC must be filed separately from Form 1040. Once you are completed with Form 1099-MISC, you will apply for a refund when you file a Form 990 or 990-EZ. The IRS will continue to accept Form 1041-MISC for tax years starting on or after January 1, 2013. The form is for those whose filing status is married filing jointly. Apr 22, 2025 — The IRS released the 2025 Form 1040. As mentioned previously the new Form 1040 has several differences to its older counterpart and the IRS is allowing taxpayers to make this change if they so desire. In short Form 1040 is not being replaced as we have been told by our friends at the IRS.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Santa Ana California Form 1040-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a Santa Ana California Form 1040-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Santa Ana California Form 1040-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Santa Ana California Form 1040-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.