Award-winning PDF software

Form 1040-EZ for Wyoming: What You Should Know

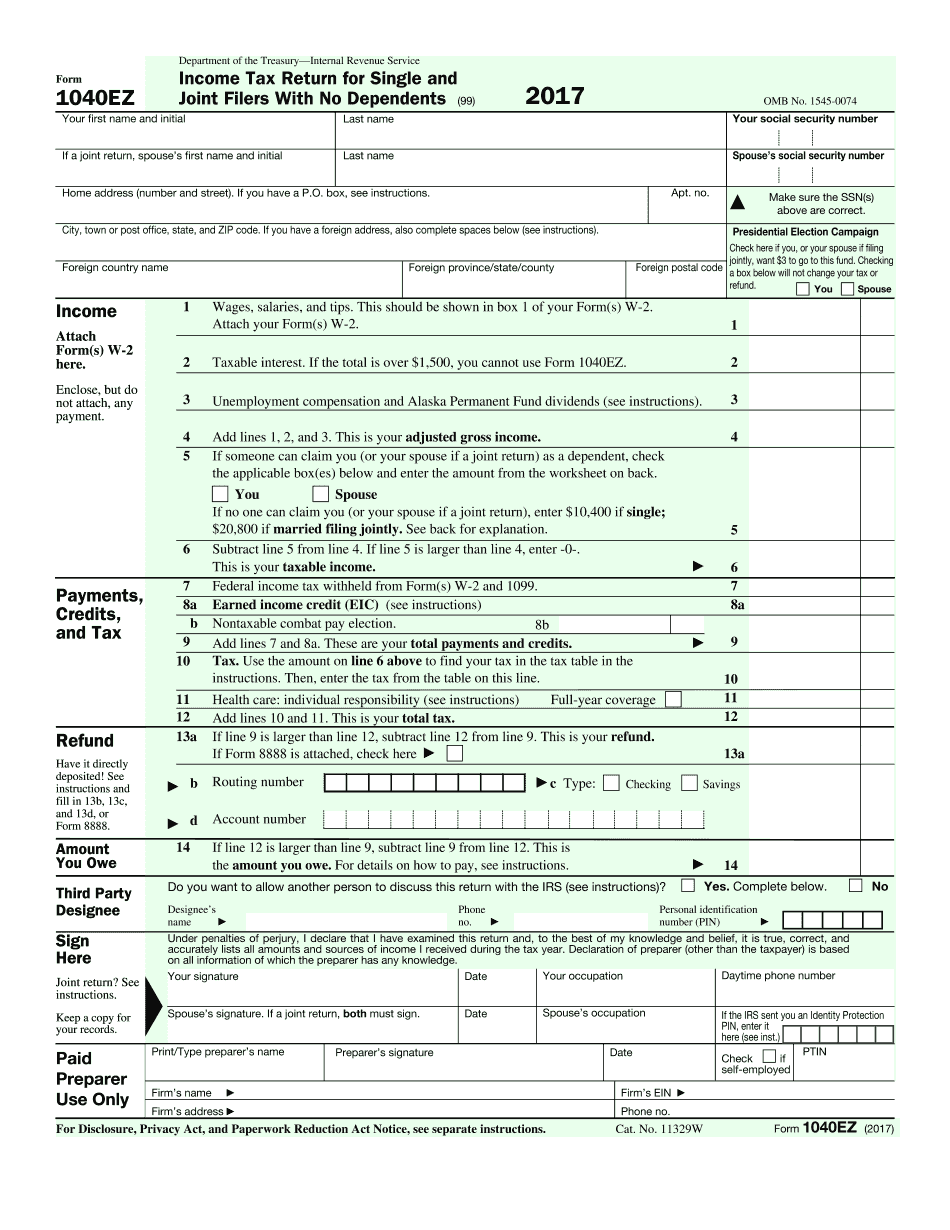

Form 1040 and Form 1040EZ have different purposes to report tax information to the IRS, but they share many similar features and use many of the same tables. A Form 1040EZ is for filing by certain taxpayers with gross incomes above 600,000 and certain other special circumstances: Form 1040EZ is not for filing if you have not filed a federal tax return since 2025 or are filing a tax return for any other state or tribal government on the date of mailing. Also, you are advised to wait until after all the state income tax returns have been received from your state tax authority before you file your federal return. H&R Block offers a variety of paper and electronic forms that are useful for most taxpayers, and you can get a list of the forms available at this website: For tax information and advice on tax law, to report errors, and to get answers about federal tax law, You can find a variety of forms and information for tax planning at the IRS's Tactics.gov website. A Form 1040EZ or 1040A is for filing a federal tax return for those taxpayers with taxable income of over 100% of the Federal Poverty guidelines, and a Form 1040 for those taxpayers with income of between 100% and 400% of the Federal Poverty Guidelines who are not currently filing a federal return. A Form 1040 (or 1040A) is for filing a Federal tax return and filing forms for a limited number of tax years starting July 1, 2009, and ending December 31, 2011. These forms are also used as part of the American Opportunity Tax Credit. All Forms 1040 are required by the tax law and include income and payroll tax information. A complete list of these forms is included on IRS.gov at “Tax Forms, Instructions, and Resource Locators.” Forms W-2G are for employers who issue Form 1099-MISC and pay taxes on W-2s. Many employers withhold federal and state income taxes from W-2s they file, which may be the equivalent of withholding federal income taxes from wages. The form includes information on payroll and payroll taxes and a “Pending Refund” box to indicate W-2s are due and have been paid. Employers may use Form W-2G to issue refunds in connection with Forms 1099-MISC. A Form 1098 is a refund or credit of tax paid by a taxpayer to the government.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040-EZ for Wyoming, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040-EZ for Wyoming?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040-EZ for Wyoming aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040-EZ for Wyoming from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.