Award-winning PDF software

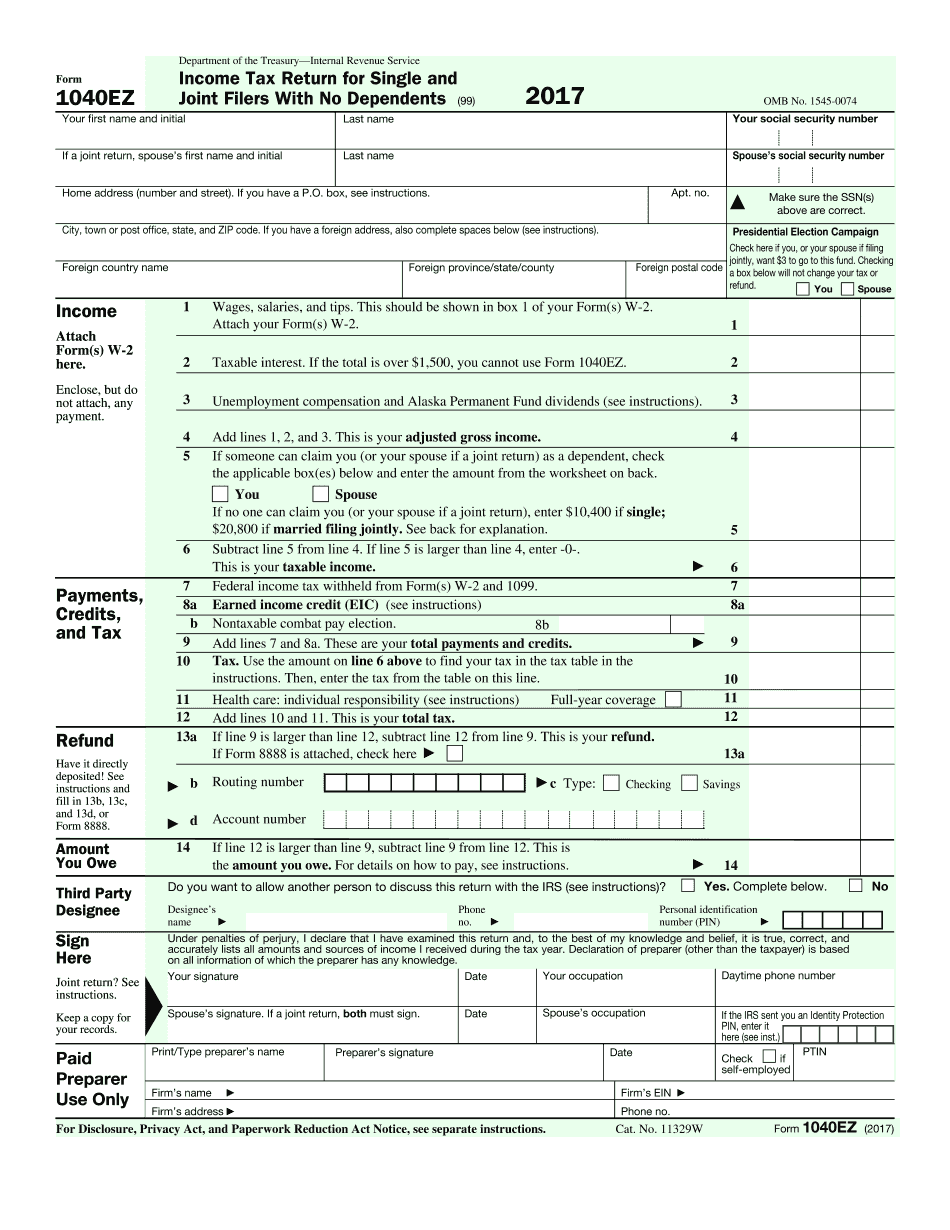

Form 1040-EZ MS: What You Should Know

IRS form 1040) Before You Start — Choose Direct Deposit The new direct deposit system means you no longer need to mail a paper-less mail-in tax return. You will receive your Form 1040 and instructions for payment and e-file on your paper form. No paper-less filing means the time you spend on paper filing will be significantly reduced, saving your time, money and energy, saving you money, money and energy, and freeing tax-payers from being forced to work through the mail to file their returns. However, the new direct deposit system may not be ideal for many taxpayers. Before You Start — Choose Direct Deposit Your old tax refund, which you received directly as a tax return, will always be mailed to you. IRS form 1040 includes an instructions section that covers how to use direct deposit to avoid paper filings. However, for those who don't want to mail their tax filing documents directly to the IRS, there are many other ways you can save yourself time, money and help reduce the number of paper filed tax returns. There are two main ways to save time and money on your tax return or return, and this is a time saver in the event you make certain types of mistakes. Both savings systems are the same, but the tax systems are slightly different. To find the savings, look into this two-month period: August 2025 to January 2019. As an example, if you have a 2025 Form 1040 or 1040A, and you are filing for 2018, consider filing either Form 1040EZ or 1040A. However, only filing Form 1040EZ will save you the smallest amount. There are four main ways you can save, not including time: The ability to save up to 35% on your tax payments by going Direct Deposit. The ability to save time if you need to take more time filling out IRS forms online. The ability to save money in less time by choosing Direct deposit. The ability to save money by choosing to file online on your desktop or by using a computer to fill out your tax forms. These are the savings saving options available in the form 1040EZ. When you choose direct deposit and make electronic payments to a bank account, then send your returns, the IRS electronically credits the bank account with the tax refund.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040-EZ MS, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040-EZ MS?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040-EZ MS aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040-EZ MS from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.