Estimated taxes were never something I had to worry about when I was working my corporate job. I got a W-2 and I paid my taxes at the end of the year. I had taxes withheld from my paycheck because that's what you do when you have a W-2 and a normal paycheck as an employee. It wasn't until I started working for a small business and had my own business that estimated taxes became a huge part of my life. So, they might be part of your life too if you're a small business owner. And that is what this channel is all about. We're trying to help small business owners with their financials. This video is all about helping you calculate and understand estimated taxes and estimated tax payments. If that sounds interesting to you, this video is meant to be timely as we are in January and there is always an estimated tax payment deadline in January. So, hopefully, it's timely for you. Stay tuned if you need any help on estimated tax. If this is the type of information you need for your business, please subscribe to the channel because we will keep bringing this kind of content and try to make it as timely as possible. Also, make sure you click the little notification button so you know when new content comes out because I do try to make it timely for what's going on in the world. Now let's talk about estimated taxes. What are they and why do we need to worry about them? Estimated taxes are just part of what we have to do as small business owners. When we make money, especially when we make a profit, we are going to owe taxes on it. The IRS has a pay-as-you-go system and they...

Award-winning PDF software

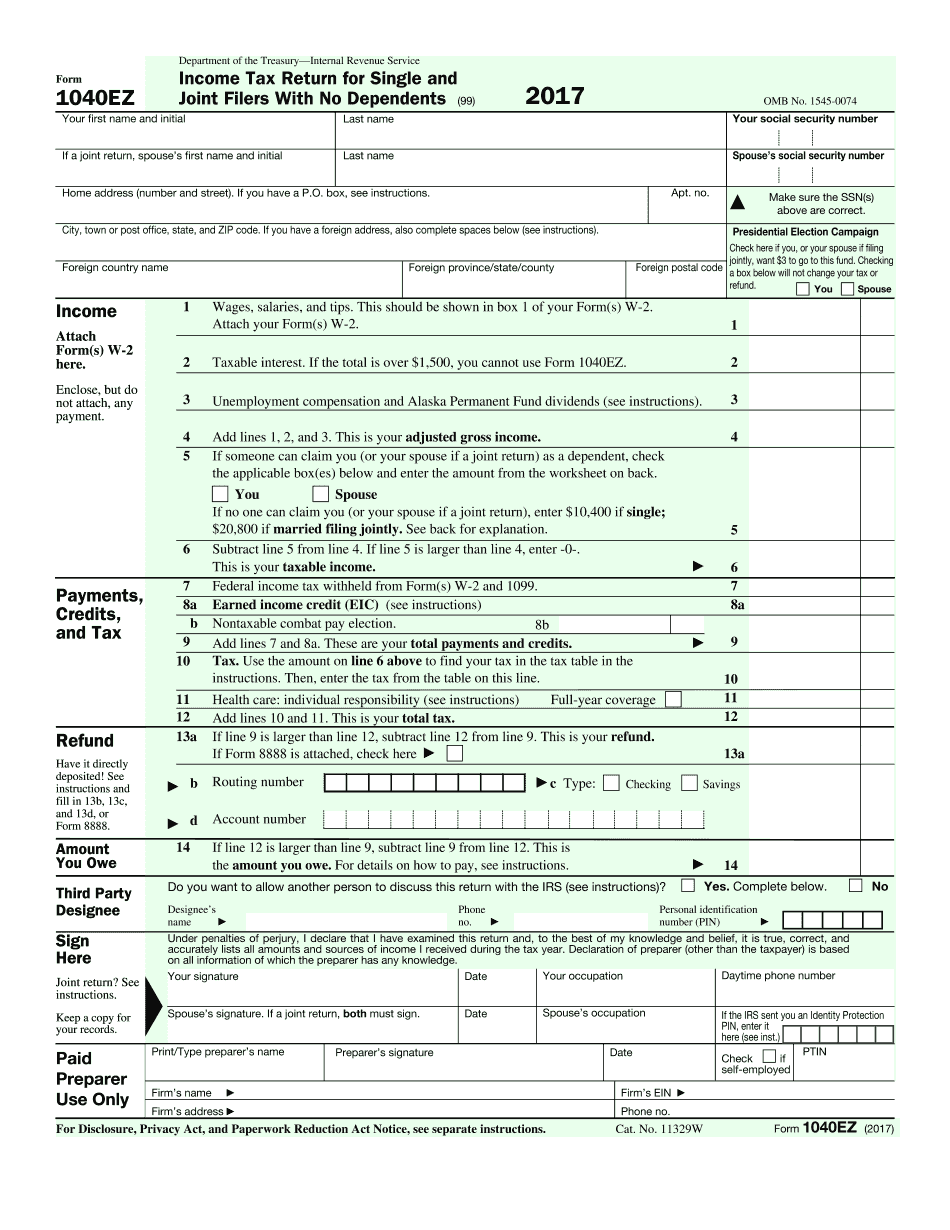

Video instructions and help with filling out and completing Form 1040-EZ vs. Form 1040-es